The Road to Homeownership Starts Here!

The Missouri First-Time Homebuyer Savings Account is now available to help Missourians achieve their dream of homeownership!

Did you know first-time homebuyers in Missouri can lower their taxes by saving money for their down payment and associated closing costs? Annually, qualifying first-time homebuyers can deduct up to $1,600 for married couples filing a joint return, and $800 for all other filers.

To learn more about the Missouri First-Time Homebuyer Savings Account, contact your local bank or credit union.

DO YOU QUALIFY? As a Missouri resident, you qualify for this program as long as you haven’t previously owned a home of any kind, or as a result of the individual’s dissolution of marriage, has not been listed on a property title for at least three consecutive years.

CAN YOU AFFORD A HOME? Your local REALTOR® can help you understand the costs of buying a home and find a home that best fits your needs.

HOW DOES THIS WORK? Annual contributions are up to $3,200 for married couples filing a joint return and $1,600 for all other filers. Tax deductions are capped at up to $1,600 for married couples and $800 for all other filers.

WHEN CAN YOU START? You can open a Missouri First-Time Homebuyer Savings Account TODAY and Start Saving NOW!

Unlock the Door to Homeownership!

ABOUT THE MISSOURI FIRST-TIME HOMEBUYER SAVINGS ACCOUNT

Learn more about this new savings option for Missouri residents who are looking for ways to help save for a down payment and cover the costs associated with buying their first home.

THE ROAD TO HOMEOWNERSHIP

The road to homeownership is shorter than you think. And thanks to the new First-Time Homebuyer Savings Account program in Missouri, saving for your first home just got easier.

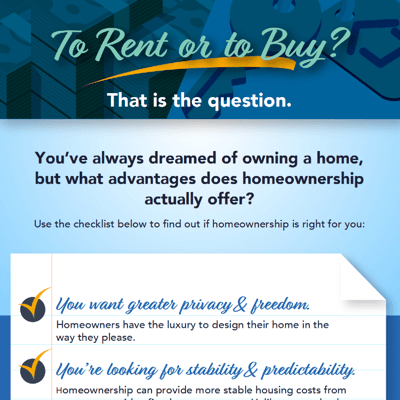

TO RENT OR BUY?

Purchasing a home is a major financial decision. Review the benefits of homeownership to help you decide if buying a home is the right choice for you.

THE PATH TO FINANCIAL INDEPENDENCE

If you’ve decided homeownership is the right choice for you, these steps can help you save for your new home and achieve financial independence.